There is so much uncertainty prevailing these days, it is natural to move into physical gold. It’s safe-haven properties have been proven over thousands of years. The attraction of owning a safe asset is appealing as the financial risks grow. People are waking up to the fact that another bust in the credit cycle is long overdue. What’s more, the Federal Reserve is bringing that day closer by raising interest rates, which for now has kept the US dollar steady.

An Important Bull Market Indicator

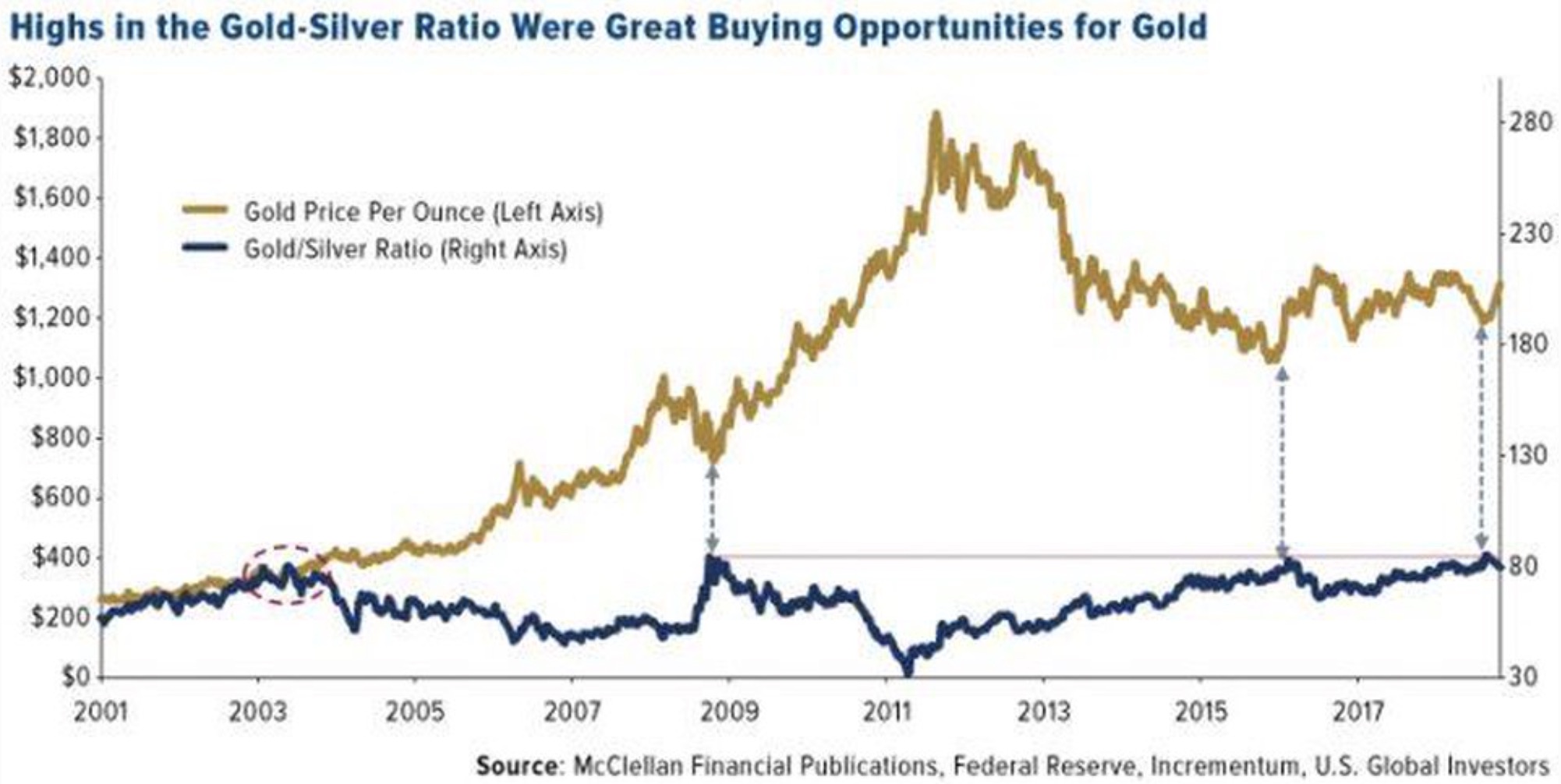

It worth noting that gold has been rising even though the US Dollar Index has remained above 95. That is comfortably above its critical support around the 94-to-93.50 area. So gold is moving higher against all currencies, which is an important bull market indicator. And silver is trading okay as well. Silver has not been strong enough to say that it is leading the precious metals higher, which is what I would like to see. But it is keeping up with gold. In fact, the gold/silver ratio has declined slightly from its high last month.

This Catalyst Will Create A Massive Upside Surge In Gold & Silver

Watch the 81 area. If the gold/silver ratio breaks below that level, then there is a good chance that silver will start leading. When that happens, the precious metals often start accelerating to the upside. I am expecting that the next few months will be good ones for the precious metals, Eric. The odds of that outcome increase if silver can hurdle above resistance at $15.